The evolving landscape of the Chilean blueberry industry

Chile’s ascendancy as a key blueberry supplier can be attributed to its unique geographic position in the Southern Hemisphere. The favorable climate and soil conditions in Chile have enabled the production of an array of fruit species during the counter-season to Northern Hemisphere markets, thus conferring a significant seasonal advantage. This seasonality was the cornerstone upon which Chile’s entry into the global blueberry market was built.

In its nascent years, Chile found itself as a virtually solitary provider of counter-season blueberries. “Chile initially was almost alone in the market as a counter-season blueberry supplier, owing to limited blueberry varieties and a lack of global competitors. As time progressed, new blueberry varieties emerged, and additional production regions emerged worldwide, notably in Peru, Mexico, Morocco, and Southern China. These emerging competitors altered the market dynamics, necessitating adaptation on Chile’s part,” says Andrés Armstrong, Executive Director of the Chilean Blueberry Committee.

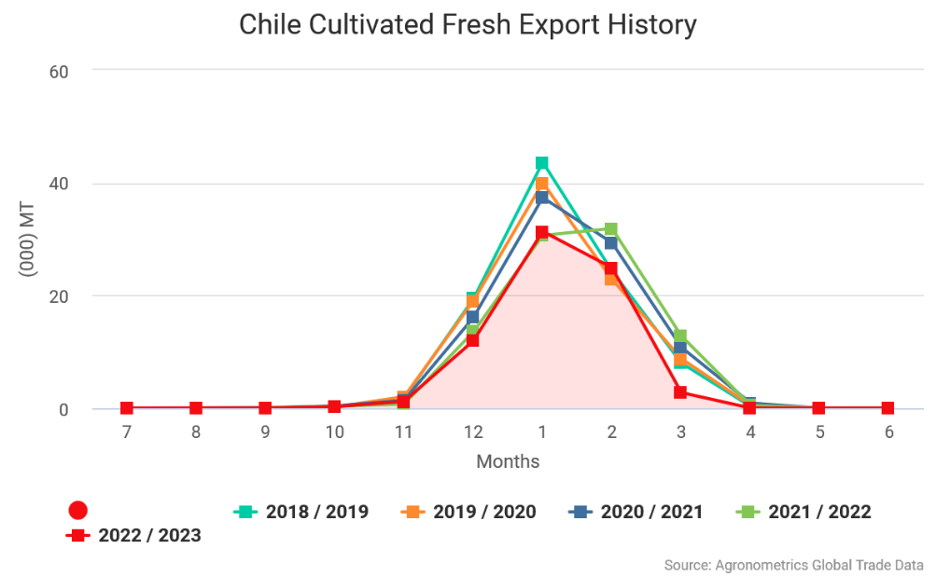

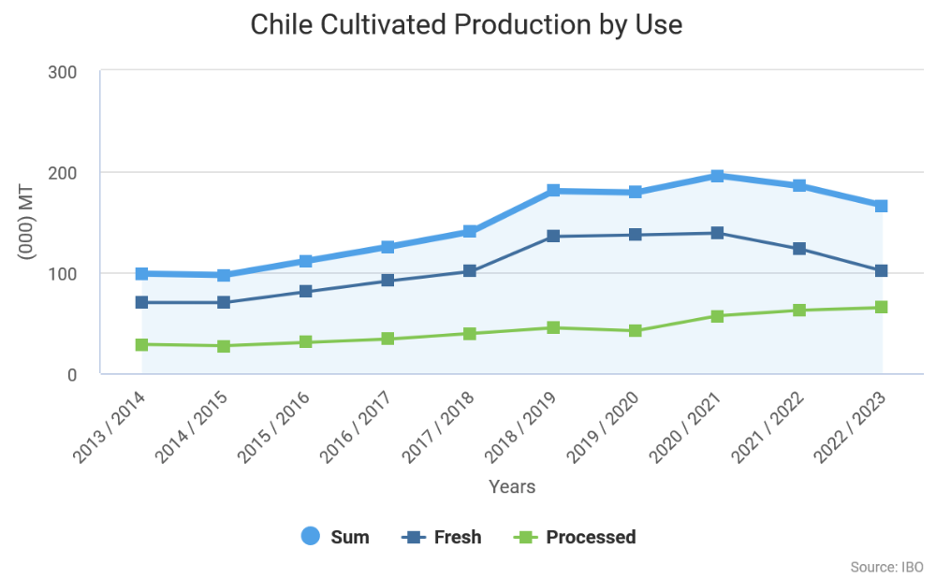

“In the last two seasons, Chile has been reducing its blueberry fresh export volumes. This season we anticipate a 6% drop in our fresh exports out of Chile. This reduction primarily stems from the reducing exports of specific blueberry varieties in the market. These varieties are either being redirected to the frozen market or altogether removed from cultivation. The replacement process for these varieties is a time-consuming endeavor, ” says Andrés.

“In the last two seasons, Chile has been reducing its blueberry fresh export volumes. This season we anticipate a 6% drop in our fresh exports out of Chile. This reduction primarily stems from the reducing exports of specific blueberry varieties in the market. These varieties are either being redirected to the frozen market or altogether removed from cultivation. The replacement process for these varieties is a time-consuming endeavor, ” says Andrés.

Chile’s ‘Blueberry Express’ service has significantly bolstered the efficiency of blueberry exports to the United States. “This charter service, bypassing transshipment activities, ensures the swift arrival of the fruit in the market, thereby preserving its freshness,” says Andrés.

The Blueberry Express service is planning to start this season even earlier. The last season commenced in week 49. This season we expect to begin in week 48, putting cherries and blueberries together in terms of exports to the U.S. market, Andrés adds.

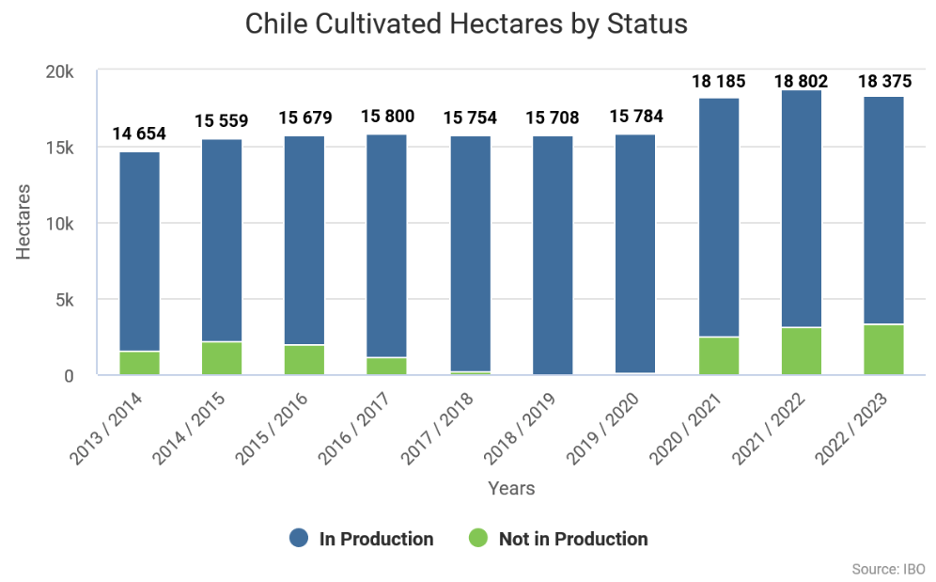

“To maintain competitiveness, Chile has made strategic adjustments. Notably, we’ve reduced our fresh blueberry exports, redirecting a significant portion into the frozen blueberry sector,” says Andrés. Concurrently, Chile is investing significantly in renewing its blueberry varieties. Growers in the region are undertaking initiatives to adopt new genetics, thus ensuring a continued presence in the global market. The fruits of these renewal endeavors will increase export volumes in forthcoming seasons.

The delayed Peruvian blueberry season initially raised concerns within the industry. The extent of any potential delay in Peruvian fruit reaching the market remains uncertain, according to Andrés. Chile’s response to this scenario is to consolidate its position as a reliable supplier, prioritizing the provision of high-quality blueberries to meet market demands. “We are working in close collaboration with the Chilean Blueberry Committee members to supply premium quality fruit that can compete in the world markets,” says Andrés.

Chile’s utilization of a ‘traffic light’ system for categorizing blueberry varieties has proven effective in guiding the industry. Varieties are classified based on their suitability for fresh exports, taking into account parameters such as shelf life and quality. Varieties in the “green” category are deemed fit for export, while those in the “red” category are considered unsuitable.

This system aids Chilean growers and importers in making better decisions regarding which varieties to cultivate and has provided a comprehensive framework for maintaining a strong and competitive product range.

The Chilean blueberry industry’s adaptability extends to the evolving preferences of consumers. Today’s consumers seek high-quality blueberries that are not only flavorful but also firm and crunchy. To meet these expectations, Chile has prioritized the adoption of new blueberry varieties and invested in advanced post-harvest technologies. The objective is to provide blueberries with impeccable firmness, crunch, size, and a harmonious balance of sweetness and acidity.

Armstrong underscored the significance of increasing blueberry consumption on a global scale. “Chile has actively invested in marketing and promotional campaigns to create awareness and stimulate the consumption of blueberries. These campaigns have targeted consumers and markets across regions such as Europe, Asia, and the United States,” he says.

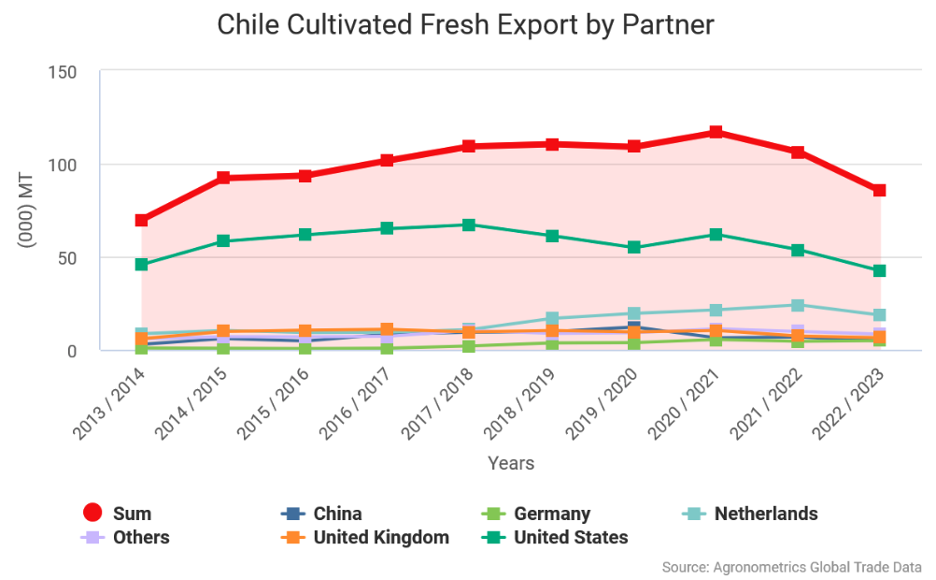

Chile’s blueberry exports have experienced expansion into diverse markets, encompassing traditional markets in Northern Europe and the UK. More shipments are being made to Japan, Thailand, and, notably, China. Markets, including France, Italy, Spain, and Poland, have demonstrated growing demand for Chilean blueberries. These burgeoning markets offer substantial growth prospects for the Chilean blueberry industry.

Despite the notable growth experienced by the Chilean blueberry industry, it confronts challenges related to increasing global production and price pressures. Meeting the increasing global demand for blueberries necessitates not only delivering high-quality fruit but also ensuring cost-effective production. The industry is resolute in its pursuit of efficiency, aiming to innovate and reduce costs across the entire supply chain.

“In the foreseeable future, the Chilean blueberry industry is poised to produce blueberries that are not only of great quality but also produced efficiently and cost-effectively. As the industry continues to expand and global demand for blueberries surges, Chile remains steadfast in its commitment to provide high-quality blueberries and cultivate a culture of enhanced consumption,” he says.

The Chilean blueberry industry has achieved remarkable growth and adaptation over the years. Through its capacity to evolve, innovate, and maintain a steadfast commitment to quality, it has sustained its position as a pivotal player in the global blueberry market. The industry’s ongoing dedication to meeting consumer expectations and venturing into new markets will be instrumental in shaping its future.

|