2023 IBO Global Production Survey

The International Blueberry Organization, in collaboration with Agronometrics, is pleased to present the results from the first ever Global Production Survey. This publication is meant as a complement to the organizations flagship publication, the 2023 Global State of the Blueberry Industry Report. Compliment the information from this report by downloading the entire report for free clicking on the link above.

The results of the survey are comprised of the volunteered opinions of 92 respondents hailing from 31 countries.

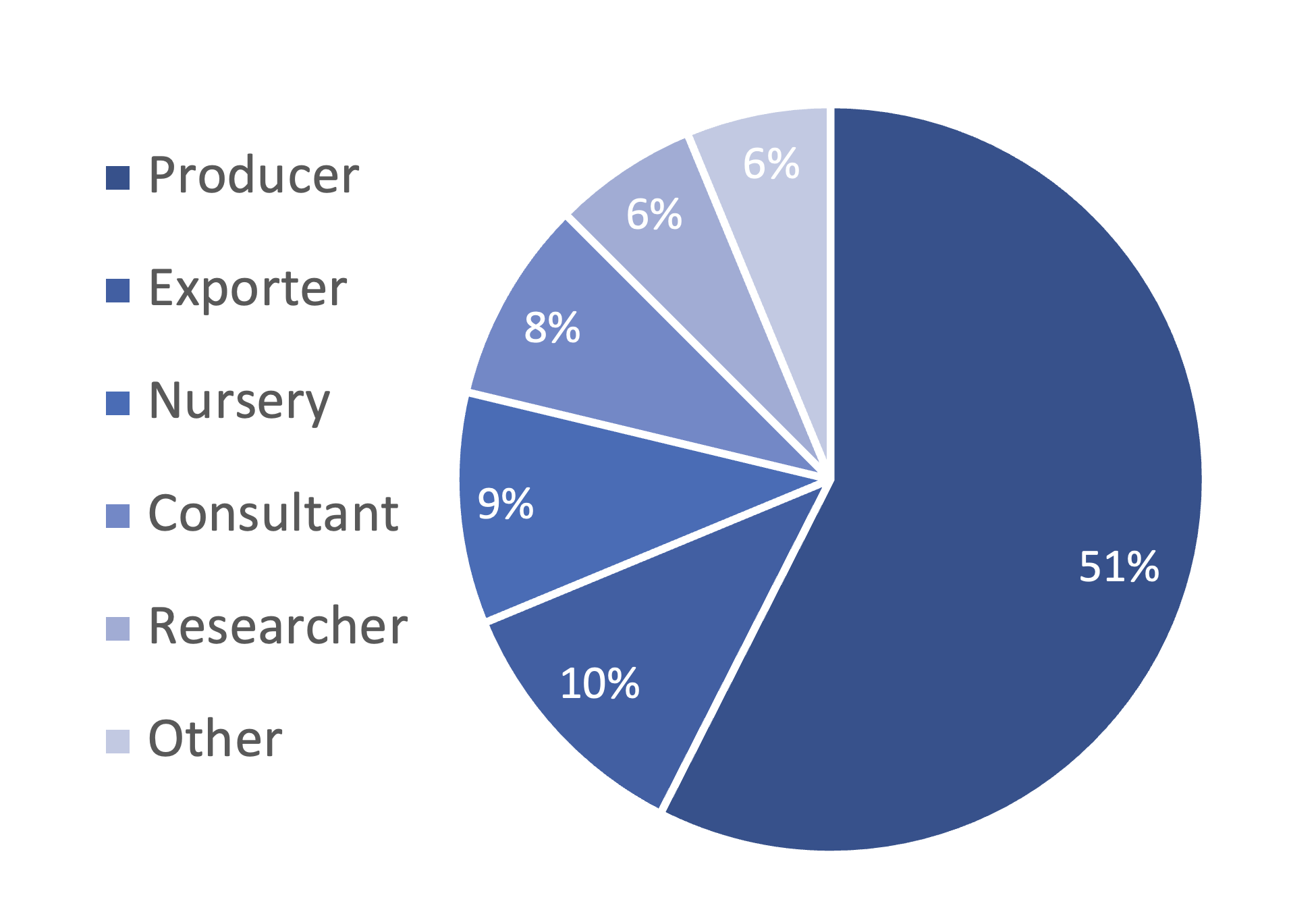

Responses by Industry Sector

The IBO is primarily a producer organization which is seen reflected in the respondents to the survey, where 61% identified themselves as producers or exporters.

The IBO is primarily a producer organization which is seen reflected in the respondents to the survey, where 61% identified themselves as producers or exporters.

The opinions reported are also coming from the people who are best positioned to guide and direct the industry, with CEO being the most common job title reported by respondents.

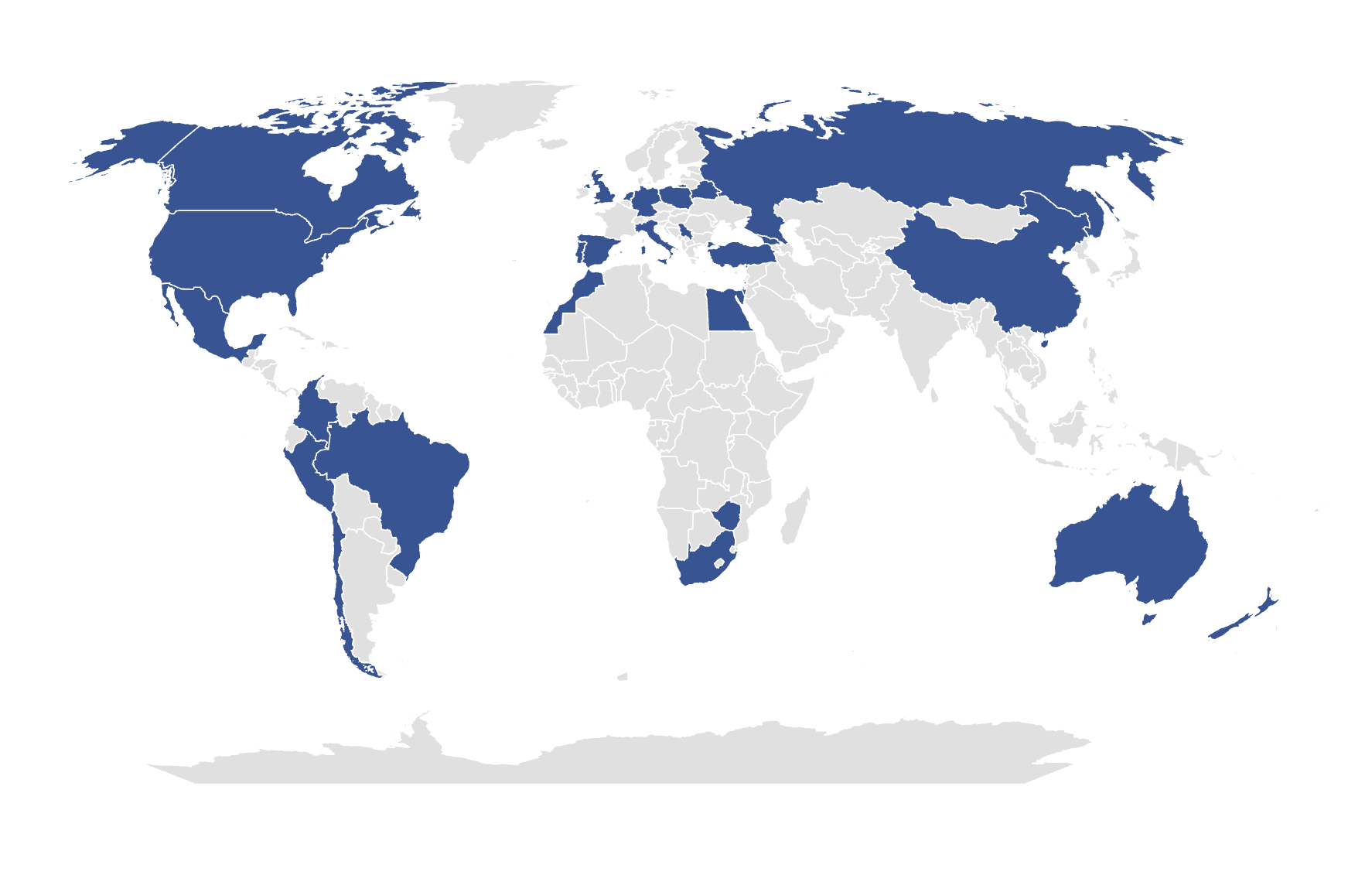

Responses by Origin

Another defining characteristic of the IBO is its international nature.

Another defining characteristic of the IBO is its international nature.

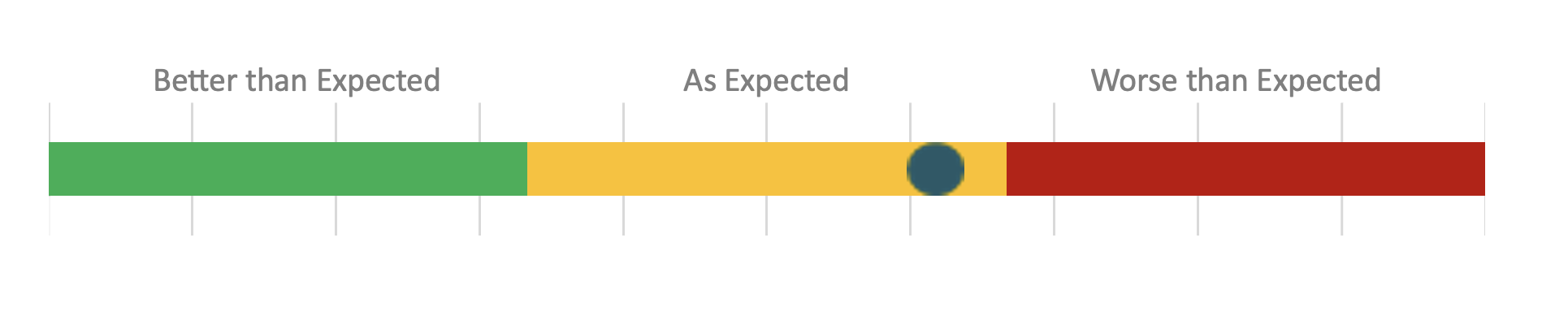

Overall Evaluation of the 2022 Season

The first question asked of participants was: Overall, how would you evaluate the previous blueberry season (crop, yield, costs, operating environment, pricing, etc) Countries such as China and Israel notably reported that their seasons exceeded expectations. Mexico and Australia slightly outpaced expectations, while Spain, Serbia, and South Africa, among others, landed just below anticipated outcomes. Contrastingly, the UK, New Zealand, Latvia, Republic of Georgia, Brazil, Zimbabwe, and Canada faced challenges, with their production season labeled as “Worse than Expected.” A surprising response was Ukraine who rated their season as slightly better than expected with one respondent commenting that it is fortunate that fighting is not happening where production is centered. The cumulative result from all regions offers a season that fell slightly below expectations.

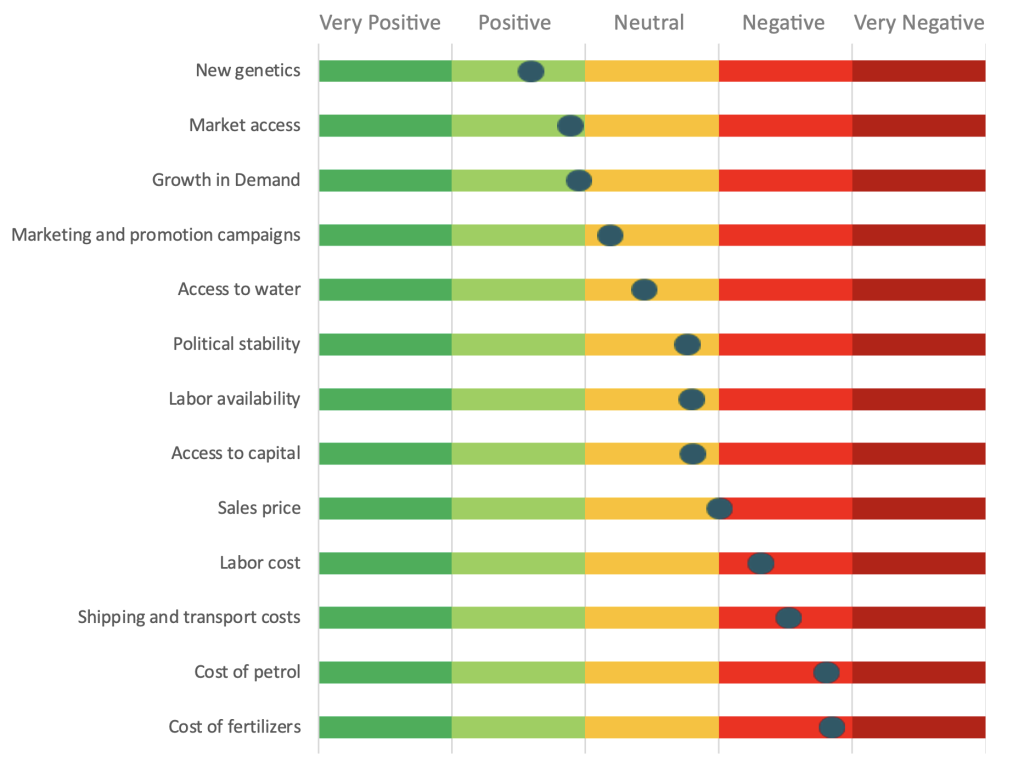

Factors Affecting Global Blueberry Production in 2022

When looking to explain the cause of some of these trends, the survey asked respondents to judge how 13 different factors affected their season, when evaluating in aggregate of all origins, the responses offer a snapshot as to the impact of each of these factors on global production. The factors to have the biggest impact on the season (the ones that strayed farthest from neutral), were all negative, including Cost of Fertilizers, Cost of Petrol and Shipping and Transport Costs.

The latter two are inputs directly affected by the war in Ukraine, which will likely continue to impact the industry throughout 2023. Shipping and Trasport Costs, are very different as many origins, especially in the beginning of the year were still feeling the impacts of supply chain issues left over from the pandemic. By midyear, shipping prices had mostly stabilized to pre-pandemic levels, and it is expected that this factor will not impact producers as heavily in 2023. There was also cause for optimism as new genetics were seen to have a positive influence on production, as well as market access and growth in demand.

Clearly this chart doesn’t represent every producing region completely and many will find that the factors that affect their production may vary greatly from the global average. What this chart offers are indicators of the pressures the industry is feeling on the global scale. One factor that is blatantly obvious, and omitted was the weather, something that several respondents pointed out. Thank you for your contributions and we will be sure to include it next year.

Thank you to Participants

We would like to profoundly thank all the participants who took the time to respond to the survey. Many of the responses were instrumental in helping us gain perspectives on plantings and production where we otherwise had no other sources. The insights and perspectives your responses offered are already a part of the 2023 IBO Global State of the Blueberry Industry Report and the blueberry community is better off because of it, thank you again.

Disclaimer

Collecting, synthesizing, and presenting data on a dynamic and diverse industry such as the global blueberry industry begs for a disclaimer, or perhaps more appropriately, a request for forgiveness.

Without a doubt there are regions that have been neglected in this report. Over-reporting in some regions is also a possibility. The precision of figures provided varies widely, from very accurate to simplistic best guesses. The data and analysis presented in this document is therefore not intended to be presented as hard fact, but rather to capture trends to achieve a better understanding of where the blueberry industry has been, where it is today, and, ultimately, to speculate as to where it is going. Please, the authors request understanding for any omissions, errors, and other weaknesses in this report.