Blueberries of Ukraine: in-depth analyses of prices, production, and export trends in 2023

The blueberry season in Ukraine is almost over, although some market participants continue to sell remaining products. Therefore, EastFruit analysts decided to sum up the preliminary results of the 2023 season, which, despite the expectation of disaster, turned out to be not so bad.

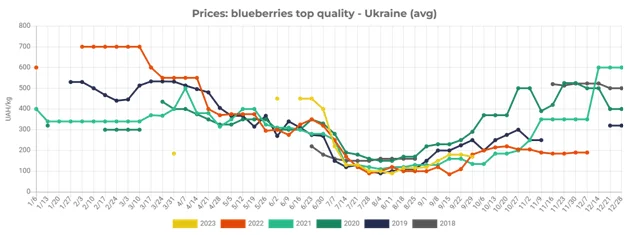

This graph shows that wholesale prices for blueberries in Ukraine in 2023 were still relatively low, although, at first glance, they did not seem to be record low. Last year, in 2022, they periodically dropped even lower than this year. Since the exchange rate has not changed significantly over the year, the situation is similar in US dollars.

However, when estimating the average price, it is necessary to take into account the volume of sales in different periods. Thus, it is more interesting to look at how the selling price changed by month. And here, as can be seen in the graph below, the lowest prices were observed precisely during the period when blueberry production volumes peaked in Ukraine – namely in July.

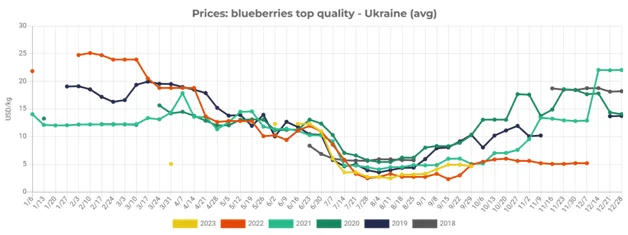

In July 2023, blueberry prices in Ukraine were at a record low for this month of $4 US dollars per kg. They were lower than last year by 21% and lower than the average in US dollars over the past 5 years by 31%.

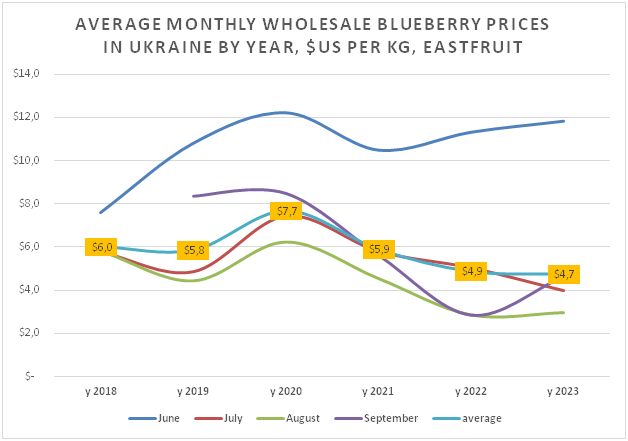

Accordingly, it was this key month that had the main influence on the formation of the average price for the entire season. Consequently, according to our estimates, average blueberry price for the whole season in Ukraine was at the record low level at US $4.7 per kg. According to EastFruit, this price was 2% below last year’s and 22% below the average over the past five years.

Among blueberry growers in Ukraine, the debate continues about what is better – to harvest the berries as early as possible, or to focus on later varieties. When is the price of berries actually higher?

Fortunately, EastFruit keeps careful records of this data, so the answer to this question can be obtained from the following graph. It is worth noting one important point – the market is constantly changing. If a market niche arises somewhere, then new participants immediately rush into it. So, analyzing the situation based on prices for previous years does not guarantee a repetition of this scenario in the future.

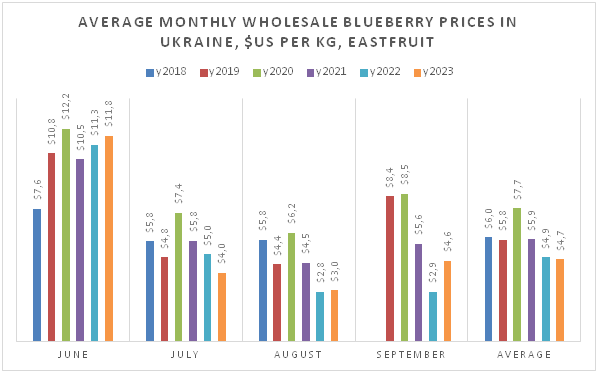

As we can see in this graph, there are no clear trends in blueberry prices. There is a definite upward trend in the wholesale price for super early deliveries. However, as a rule, June blueberries are sold in relatively small quantities on the domestic market. As volumes increase, this price may drop significantly, but the price level shows the excellent opportunities that investors have for developing blueberry production in the southern regions of the country, where presently there is no significant blueberry production yet.

Just look at the following facts: on average, over the past five years, wholesale prices for blueberries in June were 2.1 times higher than in July. Therefore, when growing blueberries in the southern regions of Ukraine, with the same investments, one can almost double the revenue! By the way, Georgian blueberry farmers are working in the same temporary niche, constantly updating export records and may soon even overtake Ukraine in export volumes.

Since in Ukraine the bulk of blueberry harvest is sold in July, this month marks the annual decline in average wholesale prices. However, July prices are still higher than average wholesale prices in August. Obviously, the main reason here is that the demand for blueberries in August seasonally decreases on the domestic market, and on the foreign market Ukraine has a serious competitor – Poland. Moreover, Ukraine exports significant volumes of blueberries via Poland. By the way, August prices for blueberries also have a downward trend. However, this is a global trend for blueberries, prices for which decrease every year everywhere, which stimulates consumption growth.

September blueberry prices are not very indicative, because in September the supply and demand for the berry drops sharply. Prices are rising at this time, and imported blueberries also appear on the market of Ukraine, often from the countries of the Southern Hemisphere, where the season is expanding. However, in September prices are again higher than in August, although in 2022 prices in September practically did not increase in comparison to August.

Have Ukrainian blueberry producers made more money?

If the price of blueberries is lower than a year earlier, then, obviously, the profitability should be lower. However, this is not always the case.

The fact is that many Ukrainian berry growers are just reaching the full yield of their plantations, so their production volumes are growing every year. And if the volume of blueberry harvest increases, then, as a rule, the operating cost of cultivation goes down.

However, there is another factor that has to be taken into account – the inflation. If previously it was ignored, now it is simply impossible not to take it into account.

Annual inflation for the dollar and euro until 2021 was around 1% or lower, so it could be ignored in the price analysis. However, in 2021, dollar inflation jumped to 4.7%, and in 2022 it was completely shocking, showing an incredible 8%. The situation with the euro was no better – in 2021 inflation reached 2.55%, and in 2022 – 8.83%.

What does this mean in real numbers? If we take the average wholesale price for premium blueberries in Ukraine for the 2023 season, which, we recall, amounted to $4.7 US dollars per kg and remove the inflation indicators of the last two years from the price, then in 2021 prices it will be equal to approximately $4.1 US dollars per kg. Let us recall that in 2021 the average wholesale price for blueberries in Ukraine was $5.9 US dollars per kg.

So how much has the real price of blueberries fallen in Ukraine in two years? The nominal price decreased by less than 20%, but the comparable real price dropped by 30%! This means that the real income of blueberry producers in Ukraine has decreased significantly, requiring higher efficiency from them to maintain their income levels.

And this does not consider all the difficulties that Ukrainian farmers faced during the Russian aggression against Ukraine. After all, it is now even physically difficult to find enough people to harvest blueberries, not to mention the rapid increase in labor costs. There is also a huge shortage of qualified specialists, agronomists, engineers, etc. And these problems, unfortunately, may get even worse in the near future.

Is it worth investing in blueberry cultivation in Ukraine?

Given the constant decline in the level of income of blueberry producers, the issue of the attractiveness of investments in this business is constantly coming to the fore. After all, we cannot accurately predict further developments in this market. Of course, we understand that in war conditions investments always decrease sharply, but we will not take this factor into account in the analysis today.

“There are several obvious points that should be considered when making a decision about investing in blueberry cultivation in Ukraine. The first is that any further development of blueberry production in Ukraine is possible only by increasing exports. This means that the grower must have: a) the minimum volume required for exports; b) high quality products; c) opportunities for investment in exports,” says Andriy Yarmak, economist at the investment Centre of the Food and Agriculture Organization of the United Nations (FAO).

A striking example of how you can efficiently organize blueberry production and export business is the case of the company “Nikdaria” (TM iBerry), who now directly supplies supermarket chains in three EU countries.

“Every investor should evaluate how many hectares of blueberries he/she needs to have in order to pick 15-20 tons of blueberries within 2-3 days. In addition, in order to get a good price, it is necessary to have the ability to quickly optically sort and package all these products, and, of course, the capacity for rapid cooling and storage of blueberries. Naturally, in the first years, while production volumes are small, it is worth trying to work with supermarket chains on the domestic market to work out all the aspects of product quality management,” explains the expert.

As for further forecasts for the development of the world blueberry market, Andriy Yarmak believes that they are quite good.

“The consumption of blueberries in the world, in my personal opinion, will grow faster than other fruits and berries. This is a very convenient berry for consumers, which can be stored for a rather long time, has a pleasant taste, and, among other things, is also considered very healthy. However, further growth in blueberry consumption will be possible only by reducing nominal prices for it, at least in those countries where blueberries are still rather expensive,” the FAO expert forecasts.

In his opinion, there are both pros and cons for the development of blueberry production in Ukraine.

“On the one hand, blueberries are a berry that can be grown anywhere in the world. And this is bad news for Ukraine, because competition will increase. For example, in the countries of Central Asia, one might say, blueberries are not grown at all, and prices there reach $40 dollars per kg per. However, it cannot be ruled out that in 5-7 years they will begin to export this berry and begin to create competition in the world market. On the other hand, Ukraine thanks to its climatic conditions can produce the highest quality berries, which can help fetch a higher price. But so far, there is no noticeable special effort by market participants to invest in marketing, which is essential to achieve high prices. Also, the market window when blueberries can be harvested in Ukraine is quite good in terms of potential competition in the market. Moreover, blueberry cultivation can and should be expanded to the south of the country to increase the possibility of obtaining higher prices,” says Andriy Yarmak.

Blueberry exports from Ukraine in 2023

How big will blueberry exports from Ukraine be in 2023? It is too early to sum up the results of the season, but we can confidently say that the record for blueberry exports from Ukraine will be updated again in 2023.

In 2022, Ukraine exported more than 2.5 thousand tons of fresh blueberries, and this season, according to our estimates, exports may exceed 3 thousand tons for the first time. According to preliminary estimates, blueberry exports from Ukraine can even reach 3.5-3.8 thousand tons. This will allow Ukraine to gain a foothold in the top 20 world’s largest blueberry exporters.

Most likely, the Netherlands and Poland will remain the main markets for fresh blueberries, but the largest increase in exports will be observed to the markets of Germany, Great Britain and Spain. There is also information about the successful shipments of commercial quantities of fresh blueberries to the markets of Scandinavian countries.

Conclusions and forecasts

Despite the decline in both nominal and real blueberry prices, the season for blueberry growers in Ukraine was definitely quite successful. Against the backdrop of the problems experienced by Ukrainian farmers growing grains and oilseeds, one can even expect an increase in interest in growing berries and an increase in investment in this area.

In 2024, if there are no special natural disasters, blueberry production volumes in Ukraine may increase again.